Board meetings! The ever dreaded work after work, like taxes, at times it feels as if there is no end to the prep. Never fear! We have a best practice guide and a template for you to use so that you can focus on getting the most out of your trusted advisors.

Board meeting basics

Frequency: Boards should meet quarterly, with a one hour update call in between meetings. Try to schedule your meetings at least 6 mo. in advance, preferably one year.

Duration: 2-3 hours

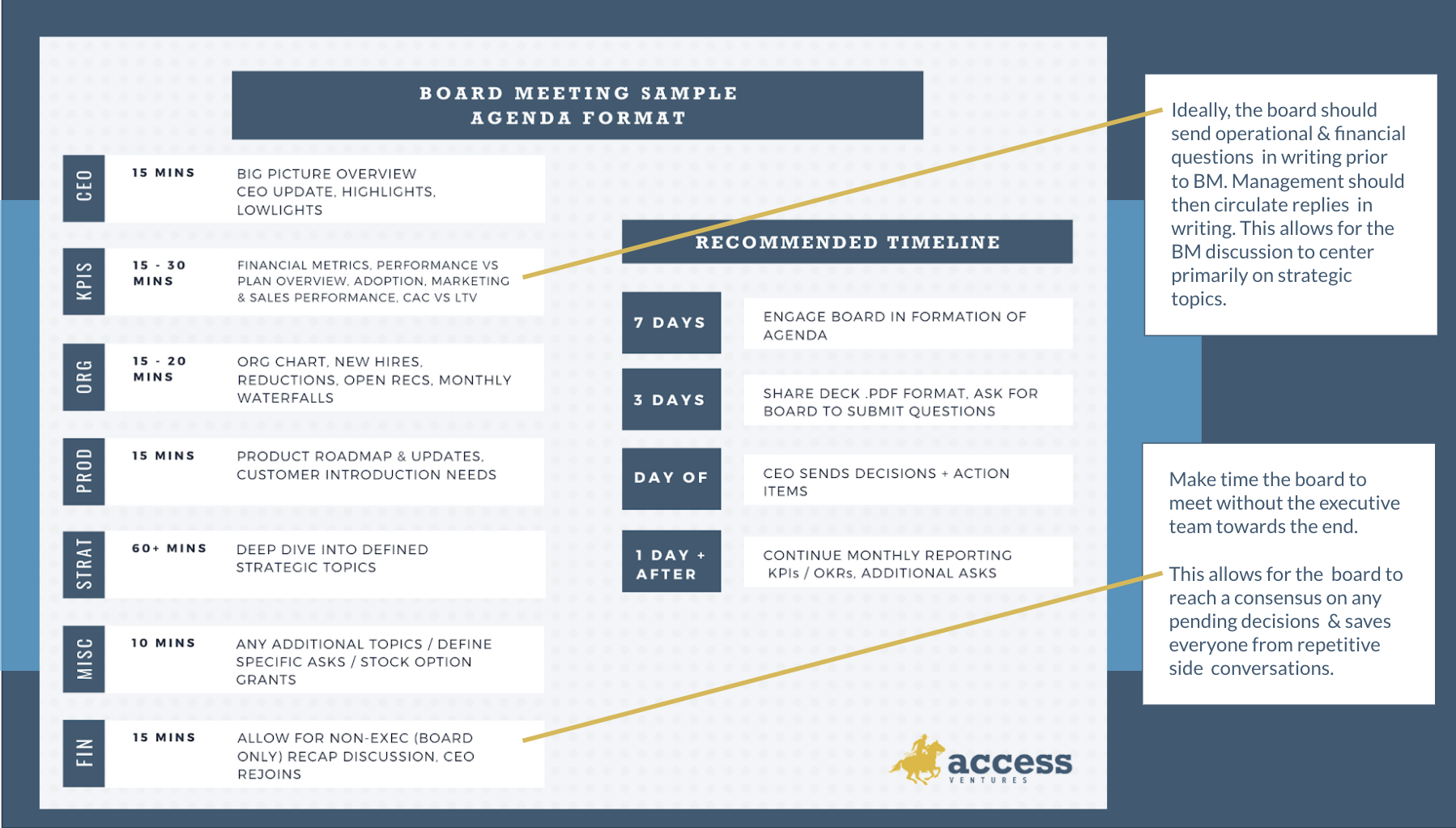

Meeting style: Set expectations that the board deck should be read prior, the BM is not a simply a powerpoint presentation share. Ask for board to send over questions in advance. Delegate someone to take succinct board minutes.

Who presents? Dept leaders should explain planned vs performance in terms of KPIs & achievements – i.e. Review OKRs here are the 3 initiatives we stated previously & how/why we performed/ what we’re planning for next quarter

Don’t forget: the board is working on behalf of your company’s best interests & don’t be afraid to share bad news. They are there to help!

What to share with board members

When to send supporting info & deck: Ideally 4-7 days prior

Use this Spreadsheet: This is a good template comprised of baseline metrics to track & report.

Additional information to send to the board:

- Option grant summary

- A spreadsheet of the open pipeline or strategic accounts (the board may be able to help navigate to the decision maker)

- Churn report with reasons coded or explained

- Prompt your board members to send questions in advance, this will allow you separate possible discussion points from concerns that can be answered in advance

- Overall, use the slides in the meeting as a high level guide to talk through major initiatives, milestones and challenges.

Standard metrics / marketing KPIs to include in board deck:

- Identify 4 key growth metrics that serve as a high-level progress guide

- Lead quality – MQL -> SQL -> Close

- SQLs per product line & channel

- MQL/SQL per segment (mid-market, SMB, etc)

- Partner marketing metrics/ traction

- Quota attainment and MQL/SQL breakdown

- Acquisition/ conversion breakdown: organic, paid, search/content

- Sign up to paid conversion (or demo to paid)

- Trials if applicable

- LTV:CAC

- New customer activity

- ‘What worked’ ‘What didnt’ ‘Still testing’

- Include MoM (i.e.3 months) or QoQ comparisions