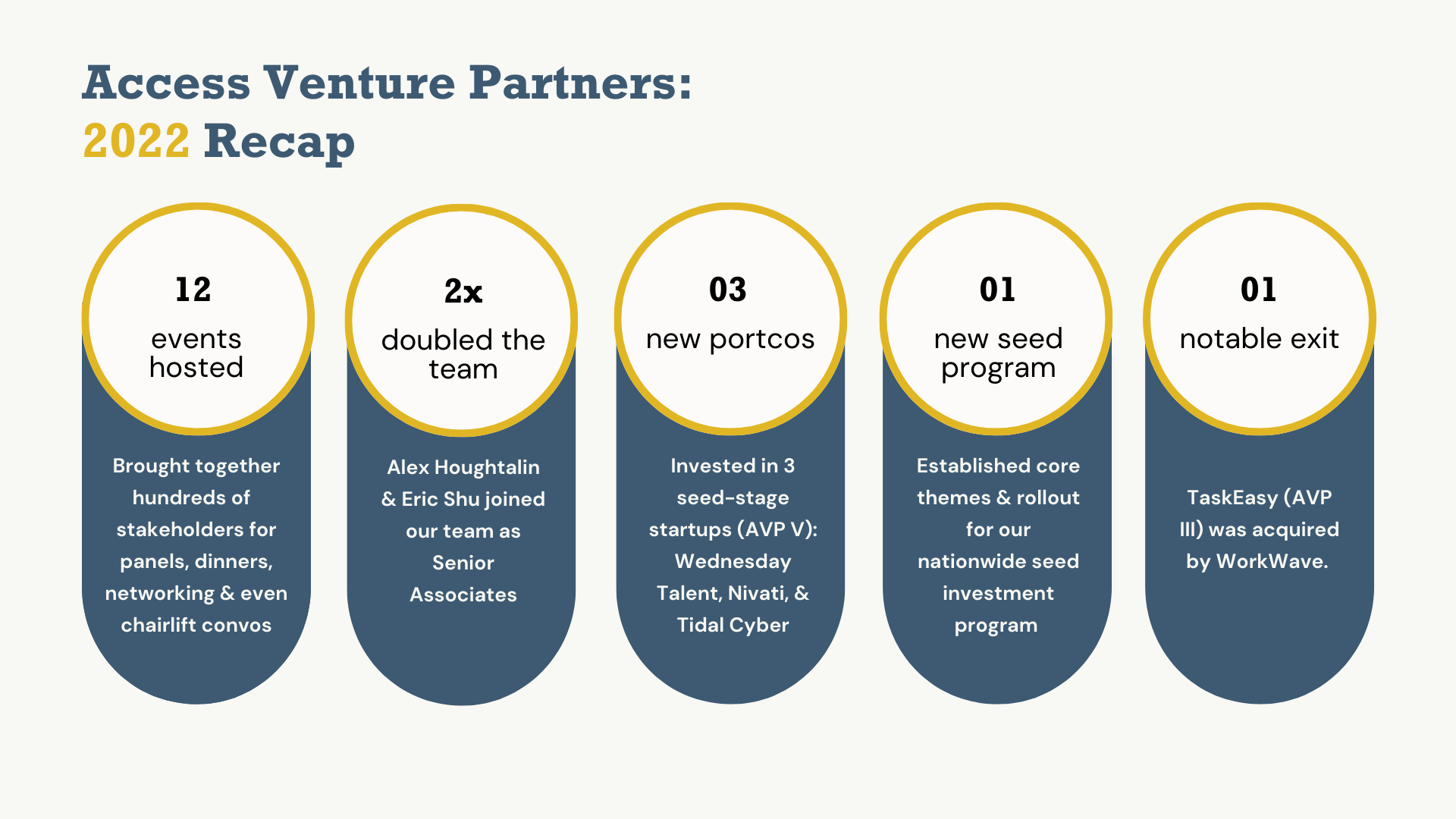

2022 snapshot of our learnings & looking forward to ’23

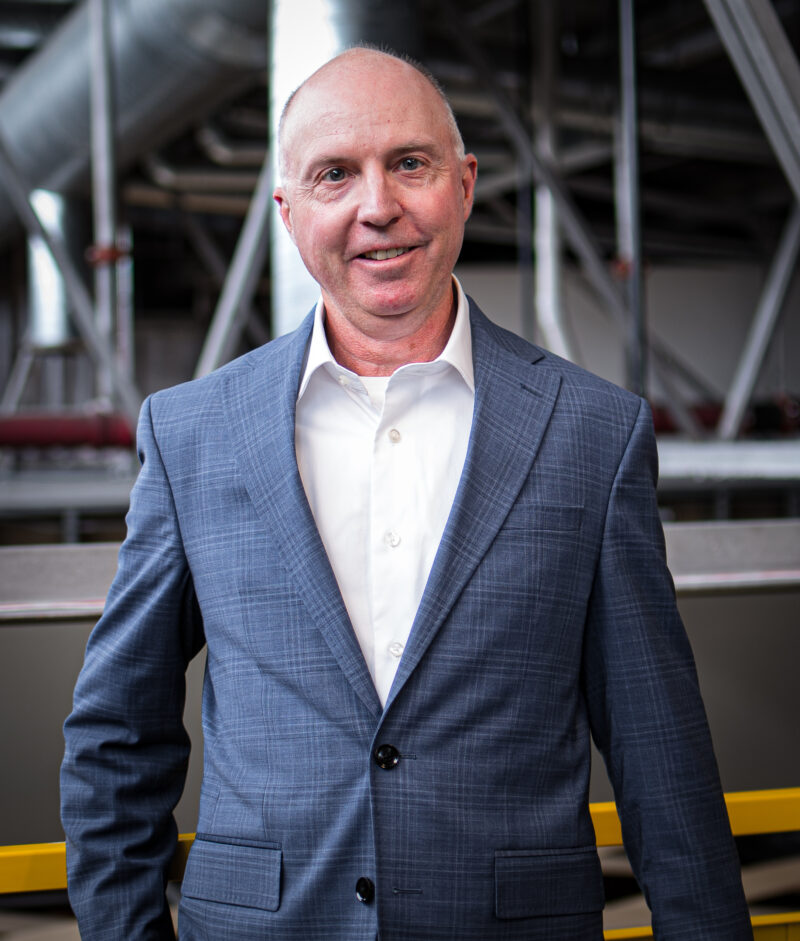

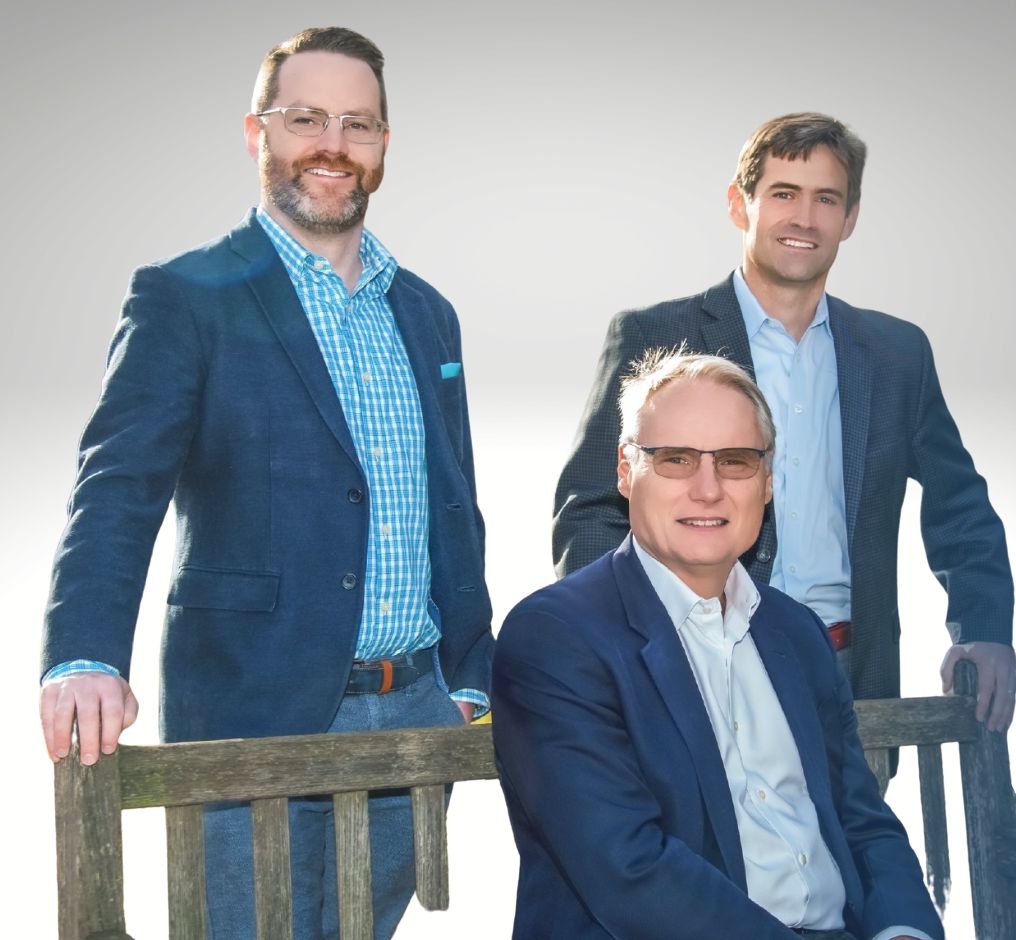

Frank Mendicino

Eric Shu

Elyse Kent

Alex Houghtalin

Brian Wallace

Kirk Holland

2022 snapshot & looking ahead with our 3 newest portcos

1. What do you see as the most noticeable innovation and/ or trends in your industry/ problem space?

More people/companies are turning to platform solutions to fill the gap that access to mental health care is preventing (i.e. shortage of therapists, lack of availability, lack of credentialed therapists) – this is good and bad. great because more people are getting proactive care to prevent from ending up in crisis, bad because there are still so many people who need support when in a crisis that aren’t getting it. I like that my fellow innovators are thinking outside the box to help solve this with technology and feel optimistic that we will see much better tools evolving as a society that will help all of us.

2. What have been the most notable milestones of 2022 for Nivati?

We closed $4MM in venture funding in March, launched our new product to clients in September, took our new website live in October, increased revenue by 119% in 2022, and Q4 was the biggest month we’ve ever closed at 56% than our next highest month!

3. What’s next for Nivati?

We are focusing 2023 on 3 things: creating a more personalized and interactive user experience in the app based on what users need help with, integrating our self-directed therapeutic resources with the live providers to make therapy more effective and require less face time with a provider, and building and tracking clinical outcomes that can be delivered back to the user and the company.

4. Any advice to founders who are going out to raise their seed round?

Great companies still get funded in any economy. Don’t let fear drive you, but work hard on driving the metrics that matter so that you qualify.

1. What do you see as the most noticeable innovation and/ or trends in your industry/ problem space?

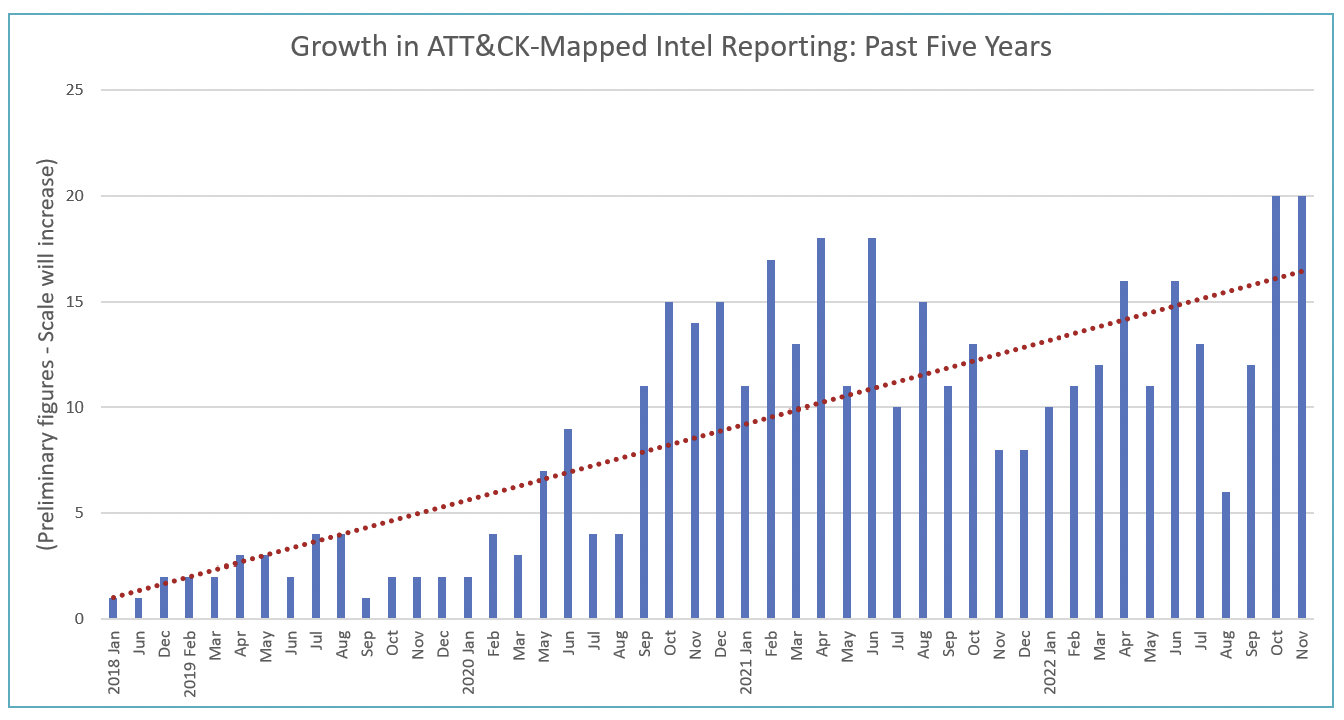

The trend in CTI toward ATT&CK Mapped TTP reporting has been profound. This demonstrates the demand for insight at a higher level of abstraction than has been traditionally reported via IOCs (indicators of compromise). This trend fuels the need to relate adversary TTPs to adversary groups, malware groups, and vendor capabilities and is the driving force behind a rapidly growing market for threat-informed defense.

2. What have been the most notable milestones of 2022 for Tidal?

- Delivery of the Tidal Community Edition and industry recognition for the innovation

- Closing four top-tier design partner customers in year 1

- Closing >$4 million seed round

3. What’s next for Tidal?

We are focusing 2023 on launching our enterprise product this quarter – Q1 – and will be heads down working to demonstrate product market fit and scaling ARR.

4. Any advice to founders who are going out to raise their seed round?

Focus on developing strong design partner relationships, invest early in experience product management skills and sprint to evidence of product-market fit

1. What do you see as the most noticeable innovation and/ or trends in your industry/ problem space?

The most noticeable trend in talent acquisition is the focus on candidate experience during the recruiting and hiring process. In 2021 it was as strong a candidate market as I’ve ever seen, and in 2022 it flipped (at least in tech), but the focus on providing a better candidate experience (pre-hire, hiring process, and onboarding) remained a consistent center of attention. Companies are realizing that their employer brand has a massive impact on their ability to hire talent and the cost and efficiency of running their talent acquisition organization. They are focusing on modernizing how they present themselves to their talent market and how candidates experience interacting with them as an employer.

2. What have been the most notable milestones of 2022 for Wednesday?

- We released our platform

- We sold our first enterprise pilot to Manpower Group, a 30,000-employee global organization.

- We got our 1st renewal

3. What’s next?

2023 is all about focus and *truly* proving product-market fit. We want to see 10x the number of channels (collections of employee videos), expansion on our pilots, and renewals. In February, we will be releasing a significant update to our platform that will make the process of collecting, managing, and publishing employee-generated video even more simple for our customers.

4. Any advice to founders who are going out to raise their seed round?

Prove as much as you can before going out to raise, use your proof points to tell a story that illustrates your vision, keep investor meetings grouped together to create momentum, be earnest and compelling during your meeting using your story as your framework, don’t be afraid to disagree or pushback, don’t get discouraged – wear your passes/rejections as badges of honor, just keep going …

If you’re a startup interested in raising early-stage funding for your tech startup, reach out to us – we invest in a cyber, SaaS & marketplace businesses at the seed & series A stages.