Future of Fitness Tech and reflections on Mirror’s $500m exit to Lululemon

by Tom Humphrey and Dylan Burton

Image : Chris Chern on Shotzr images

Image : Chris Chern on Shotzr images

State of Play in Fitness

The announcement last week of Lululemon’s $500m purchase of Mirror, a home fitness start-up that sells a $1,495 wall-mounted machine for streaming workout classes, has once again thrown fitness tech back into the spotlight.

At the start of 2020, fitness tech was poised for strong growth. The non tech fitness industry itself had grown in recent years, with boutique studio membership increasing by 121 percent between 2013 and 2017 and the $80 billion traditional gym market growing at 4% per year. However, digital fitness saw 10x that growth rate (40%) over the same period.

No company has signaled the digital fitness revolution more so than Peloton, which IPO’ed in September 2019. The success and cult-like following of Peloton has spurred an influx of new connected fitness products as the overall industry has adapted to shifting consumer preferences for flexibility and convenience. Beyond the out-of-studio workout experience, we have also seen significant growth in subscription fitness commerce and wellness/mindfulness apps.

Credit: Lincoln International

Then… a global pandemic came along and kicked things into 5th gear for the tech side of the space. A disruptive force to many industries, COVID-19 has rapidly accelerated the adoption of fitness technology as big box gyms and boutique studios have shuttered their doors. Peloton’s most recent quarterly report showed a 66 percent increase in sales, while Tonal and Hydrow saw their sales triple and usage reach all-time highs. On the mental health side – meditation app Headspace saw a 100 percent demand spike during the pandemic. Wearable fitness data, which had begun to gain early traction through corporate wellness programs pre-pandemic, is also now being piloted for the potential early detection of COVID-19 (by Fitbit, Garmin and the like).

An April 2020 survey from Harrison Co suggested that $10 billion of market share may have shifted from in-person to at-home fitness offerings purely due to COVID, even as gyms and studios begin to re-open.

What next?

So what next? With what we have seen and some of the changing signals of consumer preferences emerging, we see a few key thematic trends that we think will continue to characterize the fitness industry over the coming years:

- Continued shift from at studio to virtual / at home fitness – The recent explosive growth of digital fitness is expected to continue to drive a $7 billion market in 2017 to a $27 billion market by 2022. Negative consumer sentiment towards a quick return to in-person fitness and improved accessibility to digital fitness brands may drive this growth to even higher levels. Recent national polls indicate that only 30 percent of gym users would be comfortable returning to the gym in the next 2 to 3 months, with 33 percent saying they may not return until 2021 or later. Connected fitness equipment brands thus have a substantial window of opportunity to reach a more mainstream audience despite their generally hefty upfront price tags. The majority of these brands now offer interest-free financing plans to help would-be buyers digest this cost, while Peloton CEO John Foley recently hinted at plans to lower the company’s price point to “low-end gym chain” levels over the next one to two years. Expect others to follow suit as part of a massive continuing shift towards virtual at-home fitness offerings.

- There will likely be significant consolidation among fitness apps and services. The fitness app space is getting crowded. This has been amplified during the pandemic, as new players have spun into the market and many have offered extended free trials to new users and/or additional services to existing customers. Fitness franchises have also begun to enter the fray – Planet Fitness (with iFit), Anytime Fitness (with Wellbeats) and others have entered the digital sphere to weather the storm. Customer acquisition and retention is getting more difficult in direct to consumer, which is resulting in two things. First, many players are switching to B2B2C models targeting employers and healthcare carriers in particular for their go to market. Driving end user adoption through targeted marketing will still be critical, but removing a payment barrier to consumers will help. Such B2B2C models will also necessitate developing more formulaic approaches for assessing ROI to the B2B clients, whether cost, clinical or otherwise. We have already seen a number of companies making the shift, such as Aaptiv, Peerfit, and ClassPass, who have started partnering with corporations to expand the wellness offerings in their benefits packages. Second, it is likely we will see near term consolidation and a shift from point-to-point solutions to a more holistic consumer-centric approach to thinking about wellness – mental, nutritional, and physical. We have already seen this with Peleton moving into Yoga and Tread classes. This will be further bolstered by the shift to B2B2C distribution model as well, as enterprises prefer to consolidate their offerings to employees and members. As for the streaming platforms, with the hustle for the title of the “Netflix of fitness,” no doubt Netflix itself will make an aggressive move into the space.

- The most successful platforms will be those that develop a strong sense of community. The world of fitness is one of cultness in the physical world (think of the following that builds around a popular coach at your local SoulCycle) and that will carry over to the digital world. The ability to make users feel like part of a group has been a strength of Peloton, Strava, Zwift, and others. Features such as active Facebook groups and live leaderboards have driven personalization and social competitiveness and kept members feeling engaged and “together, but alone” when working out from home. This desire for connection has no doubt been even further engrained with the social isolation of COVID.

- AI and VR/AR will continue to heighten the opportunities for how people engage with fitness. Pre-COVID, rapid development in these areas was creating new fitness experiences and methods for remote workouts. The gamification element of Zwift and apps such as Supernatural and Beat Saber offered a fun new remote exercise option, while Black Box VR even opened a virtual reality gym. The application of computer vision and AI motion tracking in a fitness context also shows great potential in the areas of personal training and physical therapy. Existing apps in this space charge considerably less (especially with insurance or employer coverage) than the in person, oft cost-prohibitive, alternative, and come with the added benefit of a healthy social distancing.

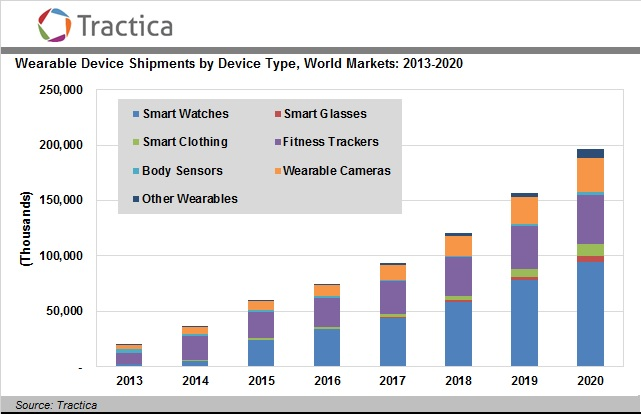

- Fitness data will play a bigger role in monitoring health and customizing fitness plans. With the growing penetration of wearables and the scope and quality of their data collection, so too does the potential for what can be done with the data grow. The aforementioned trials with wearable data for early detection of COVID-19 is one example of this. The first wave of wearable technology to date has been focused on fitness data capture and critical alerts; the next wave will focus on the customization of health, nutrition, and fitness plans based on the data. In an unregulated market, such data would inevitably feed into the way that insurance premiums were structured as it does in other insurance verticals such as auto (Metromile), home (Flyreel), or cyber (At Bay , Measured Insurance). However healthcare carriers are legally prohibited from discriminating against consumers based on “pre-existing conditions”, so personal health data cannot play a role in the underwriting process (it can in the underwriting of life insurance, and companies such as John Hancock offer policies based on wearable data and how many push ups you can do). But that is not to say it can’t play a role in the health management of consumers. Remote patient monitoring (in short, the clinical monitoring of patients remotely through the capture of vitals through wearables) has begun to gain steam in both the medicare and private insurance realms and will no doubt only continue to expand. No doubt we will see health insurers playing a greater role in the monitoring and customized support of member wellness in the coming years. We can expect increased adoption of existing opt-in programs such as Apple’s “Earn with Watch” program as well as the emergence of new data-sharing partnerships. In addition, we are likely to see the expansion of smart devices and wearable tech with new technologies emerging in prosthetics, exoskeletons, etc.

————————-

The era of flexible, connected fitness is here to stay. An already growing trend, the coronavirus pandemic has only served to force adoption and accelerate growth. It will be interesting to see the coming years play out.