Founder Guide: Advisors and Independent Board Members 101

by Tom Humphrey, Kirk Holland, and Tyler Knox

Image: Nancy Taylor on Shotzr images

Image: Nancy Taylor on Shotzr images

Introduction

Last week, I was approached by the founders of a portfolio company who mentioned they were thinking about bringing on an advisor. They had met an awesome person of high profile who was interested in helping them on their journey and offered the potential for a lot of help.

But they had a few simple questions – how do you go about bringing on an advisor to your startup? What should you be looking for in that relationship? How do you set up the right expectations? And how might an advisor typically be compensated?

This is actually a pretty common situation for many founders, so we thought it may be helpful to bring together the best wisdom we could on the topic.

“The best advisers, helpers and friends, always are not those who tell us how to act in special cases, but who give us, out of themselves, the ardent spirit and desire to act right, and leave us then, even through many blunders, to find out what our own form of right action is.” – Phillips Brooks

Types of Advisor Relationships

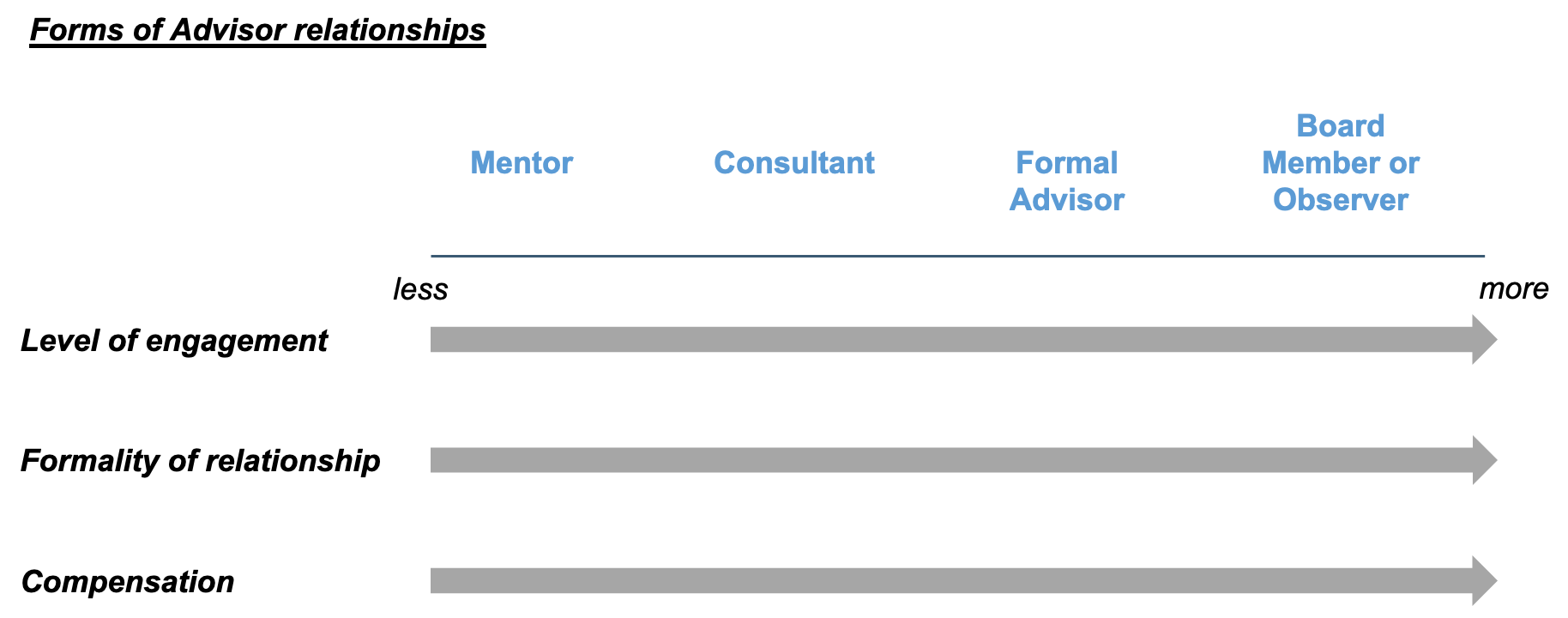

For starters, it is helpful to think of the possibilities of an advisor relationship in terms of a sliding scale of engagement, from an informal mentor at one end of the spectrum to a formal board member or observer at the other. Of course, these are not so much absolutes as dimensions, and there are many differing ways of formulating an advisory relationship.

1) The Mentor

This is the model that most accelerators employ – e.g. Techstars typically pools 40-60 mentors around the 10 companies in their programs to provide general industry and functional mentorship. Think of this as a heightened social relationship for general and typically irregular advice or mentorship. The relationship is more akin to a monthly or quarterly phone call or coffee chat with someone whose counsel you trust, whether it be from personal experience or industry expertise. There is typically no formal structure or agreement, nor compensation involved.

Generally speaking, it is advisable to start any advisory relationship here first and get a good feel for each other and the “advisory fit” before considering other options.

2) The Consultant

You can think of this as an extension of the mentor “coffee chat” arrangement. Perhaps you have an existing mentor relationship that you would like to take further. One option is to consider bringing that person onboard on a contractual basis, effectively as a consultant.

This consultative arrangement works best when you have:

- A well-defined project or scope of work to be done (with clearly defined deliverables)

- The person has the skill set and time availability to deliver on that

- You are not necessarily in need of a long term ongoing relationship

At my last company, Kanopy, we brought on a consultant to help design our customer support processes, another one to help with setting up our business analytics function, and another to help with a product management project. We ultimately went on to hire that last person to be our Chief Product Officer and no doubt the ability to test the relationship through the contract arrangement was a great way to ensure there was a good fit there.

Compensation for consultative arrangements is typically monetary based – often set as an hourly fee, monthly retainer, or set project package.

3) The Advisor

In this situation, you are bringing on someone who you want to be more involved in your company and on a regular, ongoing basis. Most commonly – the relationship might be to support the CEO or executive team with general leadership or team building support, developing a certain functional capability (e..g. Marketing, sales, customer success), or providing key industry insights / customer introductions.

This relationship will typically be formally established through a simple written agreement specifying their role and compensation. In the early stages of a startup, compensation is almost always in the form of equity; only in rare circumstances will such a role involve monetary compensation. If you start a light touch advisor relationship, and notice that the person is adding more value than expected and is indispensable, level them up to a larger advisory role and match it with a larger equity stake.

4) The Independent Board Member (or Observer)

An independent board member is ultimately a “souped up” advisor. Most companies will typically have a formalized board by the time they hit their Seed or Series A round. The board is responsible for higher-level company administrative and strategic decision making (e.g. M&A, financing, budgeting) as well as the general supervision of the CEO. The board will commonly provide founders and management strategic input, support with attracting key talent hires, give fundraising advice, help to make useful connections, and more.

For most early ventures, it’s likely that the board will simply consist of the founder(s) and maybe an early angel or VC investor or two. Sometimes an independent board member might be considered as well.

Independent board members are almost standard in public companies, are very common in later stage companies, especially as they near IPO, and are not uncommon in Series A+ companies.

An independent board member is an individual you elect to your board who is not affiliated with the executive team or major investor base. Often independent board members are brought on to help fill a gap or build a needed strength on the team – they may bring a key and unique perspective to the table (whether that be a key functional perspective such as finance; or a key industry perspective) or they may play a key role in supporting the team (such as leadership mentor). As a board member, they will accept the legal fiduciary responsibilities of being part of your board.

Observers are distinct from board members. They are individuals who may attend board meetings in person but do not have a right to vote on key decisions. Often, board observer status might be given to a non-lead angel or investor who has invested a sizable amount in a round. It is a way to capitalize on the relationship with the person and have them involved in the “team” without the full board responsibilities and powers.

This guide is focused on the latter two – advisors and independent board members. Note – from here on in when talking about “advisors”, we are referring to “advisors and independent board members”.

When does an advisor make sense?

Advisors can be assets to your venture. They will commonly have recent and relevant “been there, done that” operating experience that can help you make better decisions.

In thinking about potential advisory support, it is often a good starting point to think about 1) what are your key weaknesses and blindspots as a founder and team?, and 2) what are the critical competencies or knowledge areas you need to be successful? – and figure out where there is overlap.

At the end of the day, advisors can wear a lot of hats, but the most common are:

1) Functional support: they are an expert at (insert sales, marketing, product management, etc) and will help you build that function yourself. In other words, the advisor is filling a gap or role not currently being executed by someone on your team

2) Industry expertise / customer relationships: they bring extensive industry experience and a wealth of information on customers and/or a rolodex of customer relationships for introductions. Such advisors can be especially helpful when targeting technically complex and big enterprise industries (e.g. pharma, insurance, utilities, etc). For some areas (especially healthcare) you may need high profile experts as advisors purely for credibility

3) Emotional / leader coach: they support the founder with leadership coaching or emotional guidance. CEO’s often feel the pressure of being squeezed between two pyramids – the investors on top pushing down and the employee below pushing up. Sometimes, there are things a CEO might not feel comfortable sharing or talking about with either of those groups, and so an advisor can be helpful as a trusted and objective sounding board for questions. Oftentimes, an investor can play that role, but not always

4) Team / Hiring advisor: they are well connected into a functional area or industry and can help you recruit and build your team and attract key hires

Specific functional advising is probably less common, as at some point, you will actually want to hire for those functional skills internally. General leadership and industry expert advisors tend to be more common and always needed.

How to build you advisors?

Think like a coach

You should think about your advisor and board composition like a coach might approach player selection for each game. Every stage of your business (seed, Series A, Series B) is a new game, and the optimal players to put on the field might differ overtime.

This is not a marriage. At the end of the day, advisors are there to drive value for you and your company, and if that value starts to fade, don’t hesitate to replace an advisor. The best way to manage this, without being awkward or having to cancel equity agreements, is to keep your advisory agreements short (say, 1 or 2 years in length) so that when those agreements end, you can either choose to “re-up” or let the relationship fade (send them to “the bench”!).

Your set of advisors is often dubbed your “advisory board”. This can be a little confusing as advisory boards do not act like your “board of directors” – they generally do not meet as a group and are just a notional concept applied to the set of people you select as your advisors.

Leverage your network

This may seem frankly obvious, but your own network could already be filled with potential advisors and it is best to start there. Ask people you know and trust for recommendations too – Amy Chang, Founder CEO of Accompany, says “When I started out, I would ask the people I knew who their best and brightest contacts were for X — where X was maybe sales or software engineering. Then I’d ask for intros. I met and met and met and met people. If I felt chemistry, I followed up. If we ran out of things to talk about after talking one or two times, I didn’t pursue. If there was more density, I took note.” You need to invest to cultivate the relationship.

Identify and shoot for your “reach” picks

You may be hesitant to reach out cold to accomplished CEOs, investors, or others, but don’t. You have nothing to lose in seeking to connect and oftentimes you’ll find that people who have “made it” are actually seeking out opportunities exactly like this. Track down their Twitter, LinkedIn, and Medium to get a window into their expertise, communication style, and personality which can make your approach more meaningful.

Use how these individuals respond as a metric to evaluate their potential. If they’re receptive and actually eager to help, that’s great. If they seem cold or blow you off, it’s likely not a good fit anyway. While getting the big names on board is great, you also need them to commit.

Do not skip due diligence

You should treat an advisor as if they were a new hire. Vet them thoroughly – consider your casual coffee chats as “interviews”, plan on catching up a few times before jumping into a conversation about an advisory relationship, and do some reference checks. Be sure to inquire if there are any conflicts of interest that might exist too.

What kind of relationship are you looking for? Every advisor relationship is different but if you are seeking an engaged relationship, then you want to be challenged and not just have the advisor clocking the punch card. Phin Barnes says, “define your relationship this way: you’ll tell them what you’re thinking or planning to do, and their job is to back you into a corner and make you fight your way out.”

You want to walk away from each conversation with either a new idea or having a pre-existing one challenged. Ultimately, you want to make sure you have the right chemistry, such that you walk away from each conversation wishing you could have spent more time together.

Write a job description

This is super important and often overlooked. More commonly than not, advisor relationships are formed more casually with barely even a handshake. I strongly suggest in all situations that you write up a short job description for the advisor role, which covers both 1) the commitment you hope to get from them (e.g. “you will spend 5 hours per month with us” or “we will set up a call once per month for an hour”) as well as 2) the role you hope they will play (e.g. “you will help with sales strategy and go to market design” or “you will help introduce us to key contacts in the industry”) – to make sure you are fully aligned on what you hope to get out of this relationship and set the right expectations.

This doesn’t have to be written up in formal letterhead (email is fine) but being written down and documented is, in my view, important. You want to hold the advisor accountable.

Beware of key red flags

There are some common things that can be red flags in the process of setting up an advisory relationship:

- If the person offers up the idea of being an advisor for compensation in the first interaction or early conversations – I always find it concerning when someone pushes the idea of a compensatory relationship in general, especially when early. In general, I like it when the founder is extending the invitation to join as an advisor

- If the person has numerous other advisory relationships at play – it might be worth asking them “do you have any other advisor roles currently?”. If they respond “yes, I have these 15 other advisor positions” that is definitely a red flag for their potential commitment level.

- Confusing the need for an advisor with the need for an employee. I.e. you might think “I need an expert sales advisor” when in reality you need a VP of Sales on the team. Functional advising tends to be lower value add in general and certainly lower value than real team members!

How to compensate advisors?

Compensation is a really important and difficult part of this process.

Revisiting our early relationship scale, if you are setting up a mentor “coffee chat” relationship, you do not need to typically compensate the individual. If it is a more serious advisor relationship then some general advice is as follows:

- Skin in the game can be great – as a general rule, I find advisor relationships work well where the advisor both invests in the company in tandem with getting a sidecar advisor agreement for additional shares. This is a great way to ensure the advisor is committed to the cause

- Be careful when granting equity – there is no hard and fast rule on how much equity stake an advisor might get. A general rule of thumb for a Seed to Series A company might be 0.1% of the company (for a standard advisor) up to 1% (for a big name, game-changer advisor). When looking at an independent board member relationship, you may need to bump this up more (perhaps to swing between 0.5-2%) – given the person is accepted greater fiduciary responsibilities. The later stages you go, the less equity (as a % of company) would be given to an advisor. You should always be very cautious when giving away equity.

- Use a vesting schedule – it is standard practice to set up an advisory relationship with a vesting schedule so that the equity is earning over time in conjunction with the value added from the advisory services. A 2 or 3 year monthly vesting schedule with a 1 year cliff might be ideal – so that you have the first year buffer to make sure the relationship works, as well as the trailing monthly vesting to ensure equity is commensurate with the relationship

- Supplement out of pocket expenses – you typically will reimburse an advisor or independent board member for out of pocket expenses (e.g. costs associated with meeting with you or attending meetings). It is very unusual to pay cash compensation in the early stages of a company’s evolution

Other resources

- First Round’s “A Field Guide to Identifying and Integrating Independent Board Members” (source)

- Failory’s “Guide to Startup Advisors: Find Them, Reach Them & Secure Them” (source)

- Matt Munson on “How to find great advisors for your startup (and avoid the shit ones)” (source)

- Samaipata Ventures’“10 tips to turn your startup board into a secret weapon” (source)

- First Round’s “7 Tactics to Get the Most Out of Your Startup’s Advisors” (source)

- Techcrunch’s “What you need to know about startup boards” (source)

- Silicon Valley Bank’s “How to build a startup advisory board” (source)